October 18, 2022

Retail Traffic Trends #96: Customer loyalty – The next level

Over the last year, retailers lost over $94.5 billion due to retail shrink.

Retailers across the country are struggling to find a middle ground between preventing theft and improving the in-store experience.

THIS WEEK’S HIGHLIGHTS

- A new approach to furniture sales: Why consumers are spending more on impulse purchases.

- Retail Theft: Retailers resort to a heavy-handed approach to retail theft.

- Customer Loyalty: Examples of email personalization that drive passionate customer loyalty.

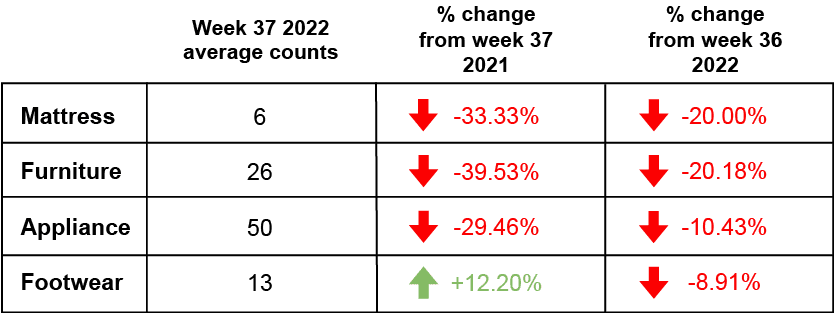

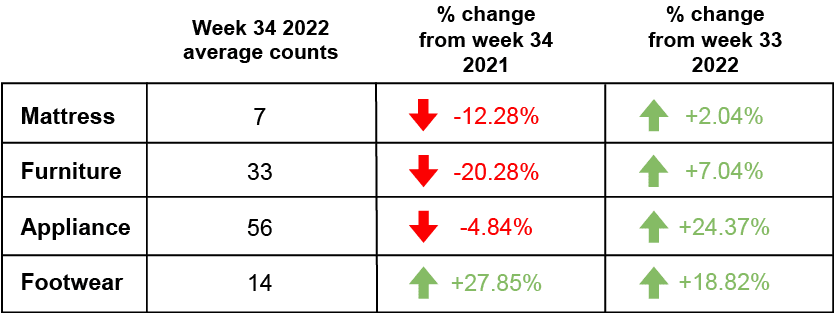

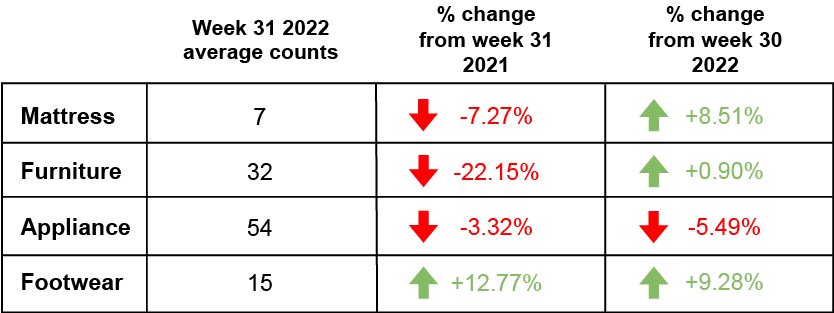

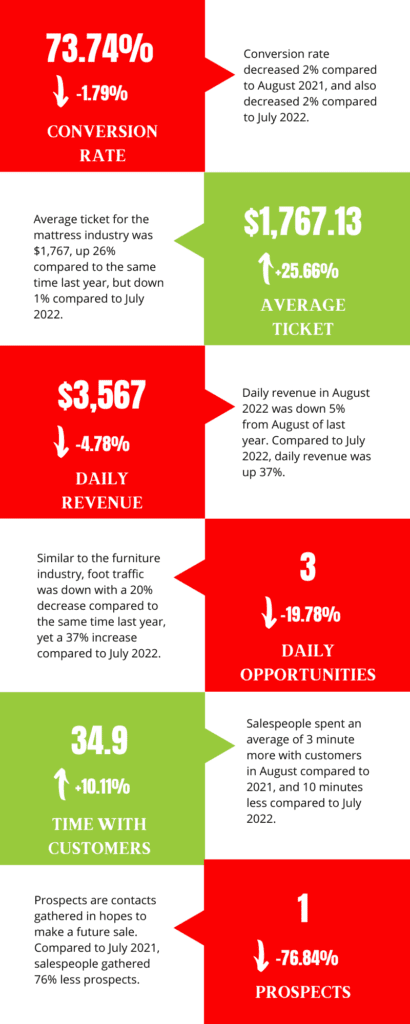

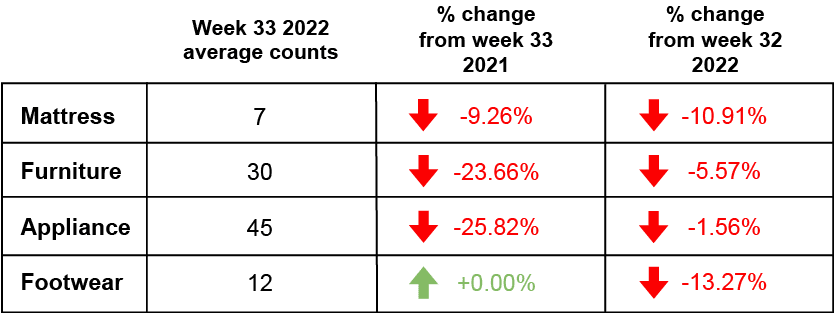

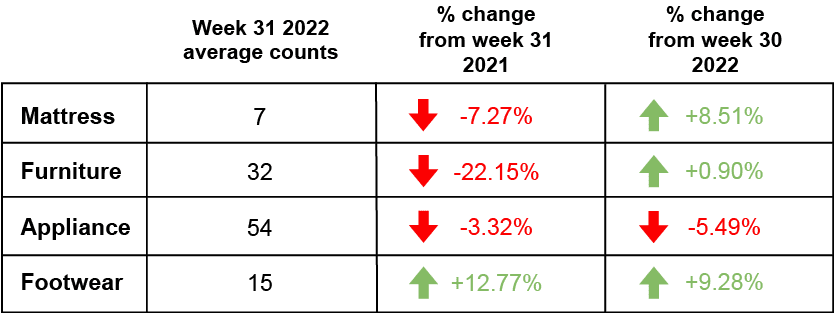

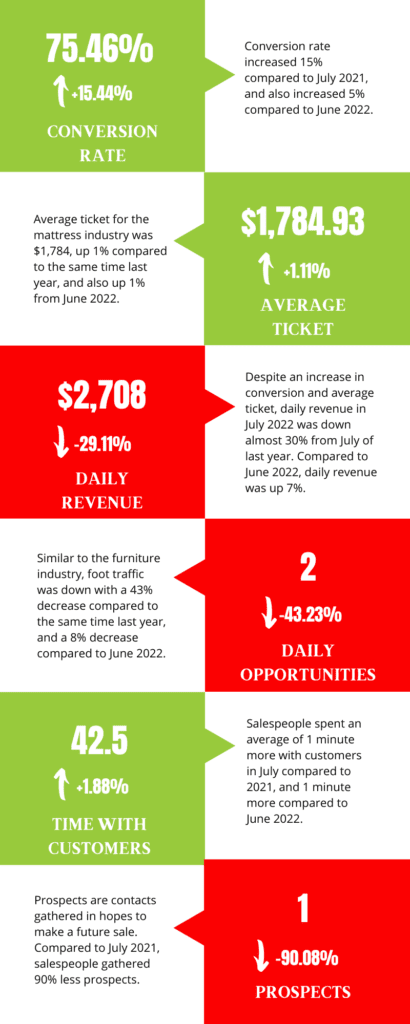

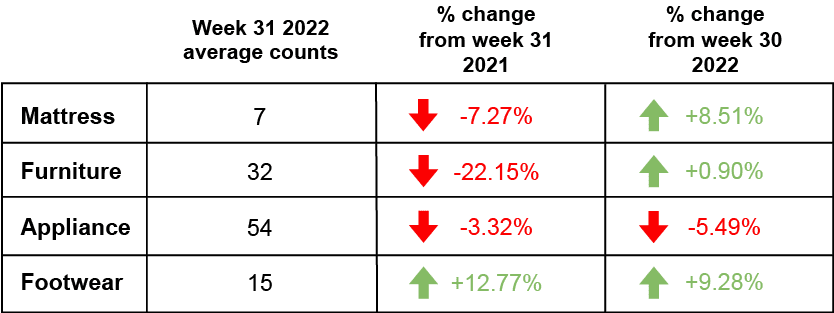

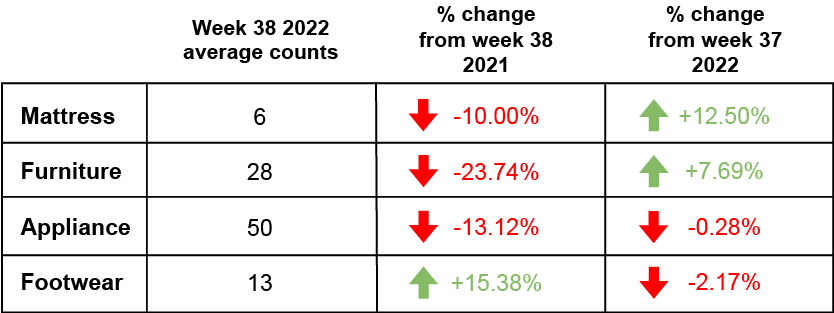

FOOT TRAFFIC INDEX

Here’s a look at last week’s foot traffic compared to the same time last year.

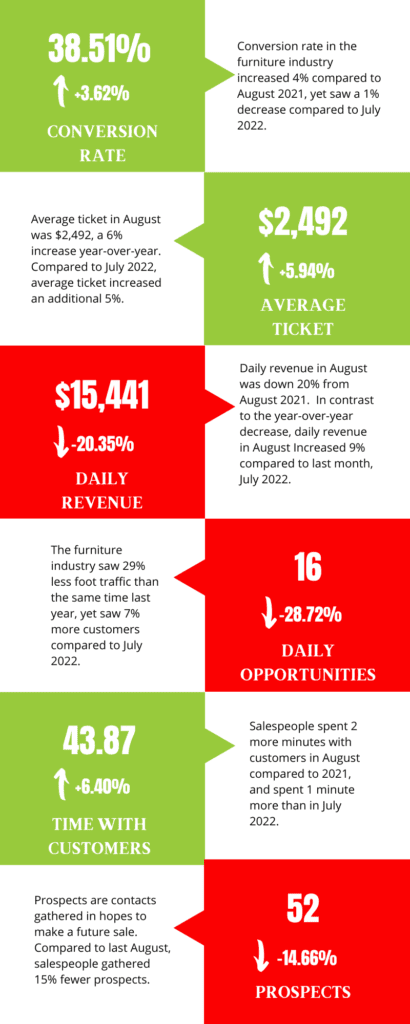

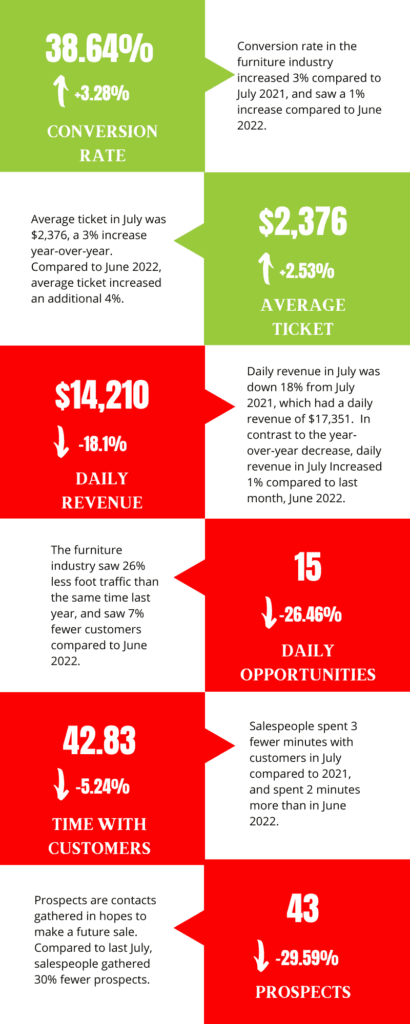

FOOT TRAFFIC TRENDS

Industry insights so you can convert your foot traffic into more sales.

From Bean Bag to Money bag

Over the last few years, Lovesac has begun taking over the furniture industry. Lovesac went from selling bean bags to nearing $500M in sales this year.

How did they do it?

Shawn Nelson, Lovesac’s founder and CEO, started just producing the sacs for friends, but within a few years, he and his business partner Dave Underwood were taking orders from a major retailer.

A single order of 12,000 units for the retailer — Limited Too — forced Lovesac to create its factory and take its business to the next level.

Fast forward to last year, Lovesac grew its net sales by over 55% in 2021 to $498.2 million, while its comparable sales grew by 46.9% year-over-year.

Retailers resort to a heavy-handed approach to retail theft

Over the last year, retailers lost over $94.5 billion last year due to retail shrink.

Retailers across the country are struggling to find a middle ground between preventing theft and improving the in-store experience.

Measures to stop theft, such as locking products up or adding alarms, have introduced friction into the buying journey as customers have to wait for staff to unlock cabinets or retrieve items from storerooms.

Then on the flip side, attempts to simplify the shopping experience may actually facilitate theft.

Despite the friction it may cause, More retailers have turned to locking items up or shifting inventory to stockrooms to keep shoplifters from snatching items off shelves.

Retail Snippets

No concern return: Walmart introduces ‘no concerns’ returns including home pickup.

Customer loyalty: Examples of email personalization that drive passionate customer loyalty.

Peak season success: Inventory best practices for peak season success.

RANDOM IRRELEVANCE

Childhood nostalgia: McDonald’s is selling Happy Meals to adults — with a twist.

DART: See the first eerie NASA images of DART’s asteroid crash site.

Uncovering Hidden Patterns: AI reduces a 100,000-equation quantum physics problem to only four equations.